- Property Flip Or Hold Meaning

- Property Flip Or Hold Online

- Property Flip Or Hold Tv

- Property Flip

- Property Flip Or Hold Game

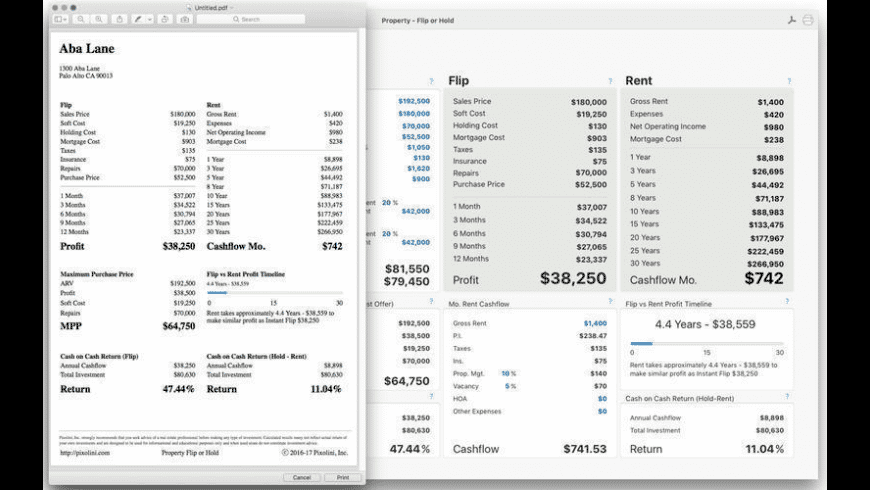

Property Flip or Hold helps the Real Estate Investor compare the return on investment to make a decision to Flip and take a quick profit or Hold and Rent property for passive income.

Property Flip Or Hold Meaning

USES

Property Flip Or Hold Online

- Property Investors

- Real Estate Agents

- Wholesale Investors

- Flip Property

- Rent Property

MAIN FEATURES

The buy-and-hold is the opposite of a house flip; instead of reselling as fast as possible for a one-time profit, the buy-and-hold investor purchases a property and then rents it out long-term. The short-term profits are lower, but it’s a much safer, and less stressful form of investment. Property Flip or Hold helps the Real Estate Investor compare the return on investment to make a decision to Flip and take a quick profit or Hold and Rent property for passive income.

- The capital gains tax rate varies based on the time the investment was held. Gain from flipping houses is taxed as ordinary income, which is often a higher tax rate than rental income would be.

- A fix and flip can be defined as a property which is purchased by an investor, fixed up and sold as fast as possible to gain some quick profit. It’s not easy to find great fix and flip properties and it’s also quite difficult to make money on them.

- Flip vs Rent Profit Timeline

- Multiple Portfolio’s or Companies

- Calculates Maximum Purchase Price based on Profit needed, Soft Cost and Repairs

- Flip Analysis detailing the first 12 months

- Rent Analysis up to 30 years

- Rent Analysis shows cumulative Cashflow summary to compare with Flip’s Profit

- Calculates Mortgage Payment

- Cash on Cash Return

- Cloud Sync between devices

FLIP

- View your Instant Flip Profit

- Sliding Profit scale up to 12 months

- Quickly see your expenses that effect your bottom line

RENT (Hold)

- View your Monthly Cashflow

- Sliding Profit scale up to 30 years

- Quickly see your accumulated cashflow over the years

Each section’s help shows calculation formulas and definition of each major evaluation.

HELP

- Value Analysis

- Maximum Purchase Price

- Mo. Rent Cashflow

- Flip Property

- Rent Property

- Cash on Cash Return (Flip)

- Cash on Cash Return (Hold-Rent)

- Flip vs Rent Profit Timeline

Property Flip Or Hold Tv

REPORT

- Print individual property Flip or Hold details

- Save to PDF

- Email PDF

Property Flip or Hold

New Udemy coursehttps://www.udemy.com/property-flip-or-hold

What Will I Learn?

- Evaluate Fix and Flip Profit

- Evaluate Rental Income Profit

- Compare Flip or Hold Property Calculations for Maximum Profit

- Analyze how long it takes to Hold and Rent to make same profit as a Flip

- Make smart purchase decisions to either Flip and take profit now or Hold and Rent for passive income

- Single page Flip or Hold Profit comparison

- Create a comprehensive profit comparison report for maximum Return-on-investment

- Calculate After Repair Value

- Calculate Maximum Purchase Price (Best Offer)

Description

This course focuses on the most important aspects of Real Estate Investment, calculations. Yes, Deal Analysis. Numbers do not lie and when trying to make an educated decision at what price a property is worth purchasing and should I Flip or Hold, Real Estate Investing profit evaluation is a must.

Property Flip

By the end of this course you will be able to calculate your Maximum Purchase Price, Profit at closing when you purchase, Equity, Cash on Cash Return, Calculate scaling profit on your Flip up to 12 months. Calculate Hold and Rent Cashflow up to 30 years. Compare Flip or Hold to how many years it might take to match Profits.

Students will have free access to Property Flip or Hold analysis tools, plain and simple it will do all of the calculations for you. Save multiple Portfolio’s and Properties.

Uses

- Real Estate Investors for personal use or others.

- Flip Property.

- Rent Property.

- Agents for their investors.

Main Analysis

- Value Analysis

- Calculate Maximum Purchase Price based on Profit needed, Soft Cost and Repairs.

- Flip Analysis for the first 12 months.

- Rent Analysis up to 30 years.

- Rent Analysis shows cumulative Cashflow summary comparing to Flip’s Profit.

- Calculate Mortgage Payment.

- Cash on Cash Return.

- Print individual property Flip or Hold details.

- Save report to PDF and email.

- Real Estate Investing.

Property Flip Or Hold Game

Property Evaluation

- Research sold homes in the property area to evaluate ARV.

- Calculate approximate Repair Cost.

- Evaluate Monthly Holding Cost.

- Lookup Property Taxes.

- Estimate Property Insurance.

- Consider evaluation as Cash Offer, Flip and Hold Mortgage.

Real Estate Investing

- No Complex Calculations

- No Long Drawn-out Analysis

- Analyze Flip or Hold Scenarios from one screen.

- Real Estate Investors new or experienced

- Real Estate Investors wanting to quickly compare profit to either Flip or Hold Property

- Agents wanting to send Properties to Real Estate Investors to compare Flip or Hold

Comments are closed.